Seller Financing

Seller Financing: Your Path to a Faster Home Sale

Looking to sell your house quickly and conveniently? We understand that sometimes it's challenging to get the price you need for your house. That's why we offer seller financing as an option for homeowners like you.

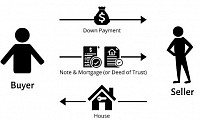

Here's how it works: Instead of relying on a bank to finance the sale, you become the lender for the buyer. We'll work with you to create a financing agreement that outlines the terms of the sale, including interest rate, down payment, and monthly payments. This allows you to sell your house directly to the buyer, eliminating the wait for a traditional mortgage approval.

Benefits of seller financing:

-

Faster closing: Close the deal on your terms and avoid lengthy bank approvals.

- More control: Structure a financing agreement that fits your needs and preferences.

- Cash flow: Receive regular payments on the principal amount, creating a steady income stream, including a substantial DOWN PAYMENT

- Tax benefits: Consult with a tax advisor to explore potential tax advantages.

Seller financing is a great option for motivated sellers who want a smooth, efficient sale. We'll handle all the paperwork and ensure a secure transaction for both you and the buyer.

Subject To: A Quick and Easy Exit Strategy for Sellers

Thinking about selling your home but facing a tight timeline? The traditional selling process can take weeks, even months, to close. Subject To offers a faster alternative that benefits you, the seller.

Here's how Subject To works: The buyer assumes the existing mortgage on your property, taking over the monthly payments "subject to" the original loan terms. This allows you to:

-

Close quickly: Avoid waiting for lengthy bank approvals and sell your house on a faster timeframe.

- Simplify the process: Skip the traditional showing schedule and open house hassles.

- Cash in hand: Receive a portion of the sale price upfront, providing immediate cash flow.

Subject To is a win-win because it also benefits the buyer by offering a way to purchase your home without needing traditional mortgage approval. This can be attractive to buyers with limited credit history or those seeking a quicker path to homeownership.

Here are some additional points to consider:

-

As-is sales: Subject To transactions often involve selling the property "as-is," meaning you won't be responsible for repairs or renovations.

- Continued ownership (on paper): Technically, the original loan remains in your name until the buyer pays it off. However, you won't be responsible for the mortgage payments once the sale is complete.